Personal loan compared to. Personal debt Snowball – Dave Ramsey are Completely wrong Leave a comment

Dave Ramsey try Incorrect In the Signature loans

You can find people that suggest that you never ever take on personal debt to settle debt. Yes, Dave Ramsey along with his supporters, I am these are you! The black and white attitude isnt according to this new amounts, but on the look at peoples mindset.

Dave Ramsey would state you to even if you can help to save a good lot of money thanks to a debt settlement financing, dont take action. I am not saying browsing dismiss the information Dave offers. I know that he bases his view on the newest choices models men and women he’s noticed. He’s got viewed one too many people who pay-off financial obligation which have that loan manage loans right up once more. According to him not to ever undertake financial obligation to repay loans, concentrating on that individuals need certainly to experience a mind-change so they check personal debt as dangerous.

Individuals will respond irresponsibly and do not work in their own interests. I watched these types of decisions while i are a home loan mortgage manager. A lot of people just who paid loans through its domestic equity only went upwards brand new obligations within just many years.

I esteem Dave Ramsey getting individuals to address the spending, bringing control of their funds move, and you can committing to a disciplined system regarding paying off loans and you will saving money, you start with building a crisis Loans one protects you however, if there clearly was an unexpected bills or death of money.

Everything i differ having try telling individuals who they must perhaps not rescue thousands of dollars which they might use to fund the really disaster fund Dave beliefs therefore very. Instead, Dave Ramsey informs you, in your “Kid Strategies,” you ought to accelerate money on the credit card companies to obtain out of loans. His suggestions should be to simply take money you could potentially setup their own pocket and spend they into the attention to your loan providers.

Keep Money, Regardless of if Dave Ramsey Wishes Creditors to have it

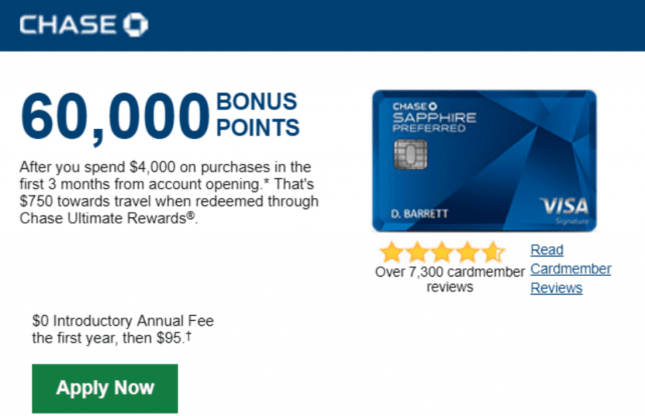

You can demonstrate that you may of debt shorter and at a lesser costs by taking for the good the fresh new obligations if for example the terminology try proper. According to interest levels on your own handmade cards and the speed your qualify for towards the a debt settlement loan, a personal bank loan is the best options.

Let’s say you have you to bank card with a great $10,100000 harmony 22% and another which have good $a dozen,100000 equilibrium 19%.

- Afford the needed minimal fee every month (a cost you to definitely decrease per month since your stability drop).

- Pay fixed count each month using avalanche or snowball approach, focusing on the best attention credit or tiniest harmony.

- Remove a personal loan.

Dave Ramsey supporters your debt Snowball, targeting the littlest bank card equilibrium basic. Again, his point is psychological. Dave recognizes that it is reduced to repay through the Debt Avalanche, for which you address the greatest attention cards, however operate better regarding into boost from watching one to credit check out $0. Given the fact that the latest dollars coupons are not have a tendency to huge that have Snowball compared to Avalanche, Dave’s section has actually deeper lbs compared to the huge discounts you are going to look for lower than when comparing a consumer loan in order to Debt Avalanche.

New example below requires sensible mastercard interest rates and you may spends an eleven% personal loan rate which is including sensible, not using the best mortgage rates offered, and this just couple borrowers rating.

If the minimal repayments are 3% of the equilibrium (and at least $20) here are the full will cost you plus the period of time to pay from the $twenty two,100000 financial obligation:

- Minimal percentage: $forty-two,995 and most 23.5 years

- Avalanche percentage, playing with $660 given that a fixed commission: $thirty-two,765 and simply around 50 days (regarding the 4 ages and two weeks).

- Personal bank loan at 11% including with an installment around $660: $twenty six,374 and you will finish the financing slightly below 40 days (slightly below 3 years and you may 4 months).

That implies it can save you more $six,3 hundred should you choose a personal bank loan in the place of following Dave Ramsey’s suggestions! In the event that a lender charge a payment for the borrowed funds, deduct they on the $6,three hundred discounts.

Could you Go along with Dave and you will Spread the fresh $six,300?

$6,3 hundred is a huge raise to you, emotionally, too. Additionally provides strong defense against the fresh new monetary amaze regarding good wonder costs or reduced money. The $six,three hundred reinforces the advantage of checking out your overall economic photo and you will and make a smart decision. After this pointers including instills the habit of preserving, as you end paying the loan and take those funds and you may, monthly, put they into your Disaster Finance discounts.

Considering most of the benefits of the non-public loan within this circumstances, and how they dovetails together with suggestions to create Emergency Finance coupons and pay down loans since a priority, it is sometimes complicated for my situation knowing as to the reasons Dave Ramsey claims this will be a detrimental choices. He may indicates is extra mindful, to avoid utilizing your handmade cards, otherwise romantic her or him, to guard facing with these people and having to the loans again.

No matter what you earn away from obligations, it is your decision to avoid shedding towards the debt once more. You can do it! If you need to, chop up the cards otherwise secure him or her aside where you you should never get access to her or him.

Do not make any decision without undertaking new mathematics. See just what speed your qualify for by the wanting a financial obligation consolidation loan. Make monthly Snowball fee Dave suggests to check out what would occurs for those who paid off the debt within the Snowball and also in purchasing the mortgage. If your savings is huge, just what will you are doing?

And that Range Can you Prefer?

If you were anyone with $twenty-two,one hundred thousand during the credit debt and there was several traces, you to for individuals who like to pay-off $thirty-two,765 and another for all of us to choose to pay right back $twenty-six,374, hence range is it possible you get into? Think about, you will be making the same proportions monthly payment in for every single line. I know and therefore range I would be in- this new long-line.

For those who answer you to, understanding on your own, youre better off adopting the Dave’s advice into letter, regardless of if they costs your thousands of dollars a great deal more, at the very least you’re making a considerate choice. I do not doubt that people want the security out-of after the Dave’s system into the letter for it to be hired.

You may choose, yet not, when deciding to take the latest savings and you will take action smart using them. Why where can i get an itin loan in Hoover don’t you take action Dave including keeps precious, financing the Emergency Checking account? You can find a great play with for this much currency, utilizing it sensibly, in a way that promotes your general financial health, not such that sucks you back again to debt.